West Red Lake Gold Reports Third Quarter Operations Update for Madsen Mine Ramp-Up

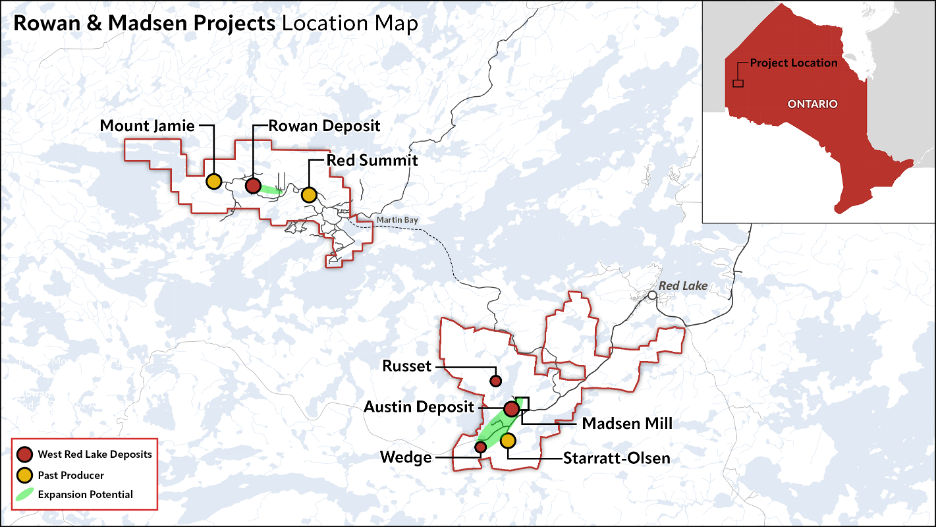

VANCOUVER, British Columbia, Oct. 07, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to provide a third quarter (“Q3”) update on the ramp-up of the Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

“Ramp up at the Madsen mine is progressing well,” said Shane Williams, President and CEO. “It is exciting to see tonnages rise, efficiencies increase, and gold production grow quarter by quarter, as planned.”

“It takes a methodical approach to step a mine towards steady state operations, ramping up daily mining while completing final infrastructure projects and underground development needs, and at Madsen we are now seeing the benefits of such an approach. Operational performance at the mine in Q3 continued within the expected range. Importantly, key parameters remained consistent, including ongoing strong reconciliation between planned and actual gold grades in modeled tonnes, and certain capital projects are starting to have notable positive impacts. I am excited to see the final pieces of this operation come into place over the fourth quarter, positioning Madsen for commercial production in early 2026.”

In Q3 the Madsen Mine produced 35,700 tonnes of ore at an average grade of 5.4 grams per tonne gold. The mill poured 7,055 ounces of gold. Note that mined and poured ounces do not align because of factors including month end timings and gold in circuit. Those ounces were sold at an average price of US$3,456 per ounce for gross proceeds of CAD$33 million.

This compares to 5,260 ounces of gold poured in Q2 for gross proceeds of CAD$24 million and 496 ounces of gold in Q1 for gross proceeds of CAD$2.1 million. Q3 gold production represented a 34% increase over Q2 gold production, a rate that positions Madsen to reach targeted output levels early in 2026.

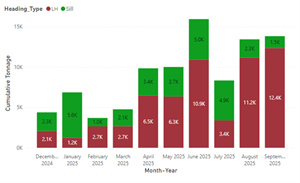

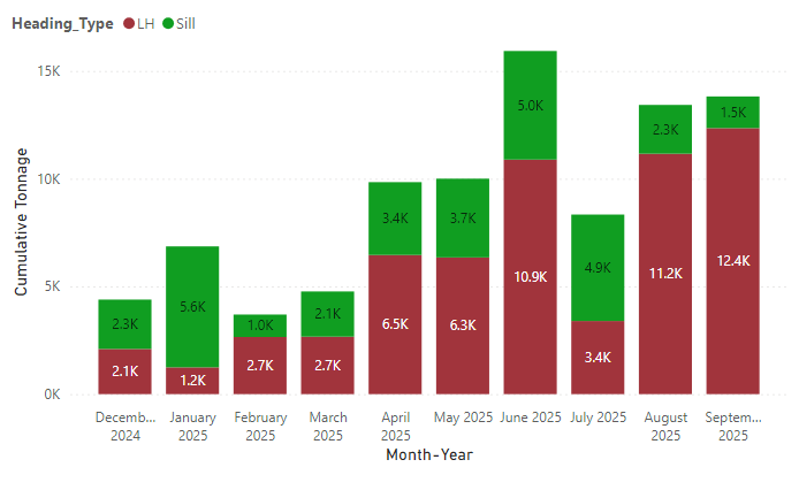

Mined ore tonnage is increasing month over month, within the variability of mine ramp up. Increasing daily mined tonnage is the primary ramp-up factor at Madsen, so the Company is pleased to report ore tonnage rising consistently.

Figure 1. Ore tonnes mined at Madsen on a monthly basis from December 2024 through September 2025.

Mined waste development is also progressing as planned, as crews drive access to new areas for drilling and mining. Importantly, as of mid-September mined waste is now being stored largely underground.

The underground waste rock storage program is a key de-bottlenecking effort recently in effect and is directly supporting the mine’s ability to move ore tonnes. In the second half of September the mine moved over 1,000 tonnes of ore per day on several days, including a record day moving 1,400 tonnes. This new ability to store all waste rock underground, which has shifted trucking capacity away from waste haulage to ore haulage, bodes well for production.

In terms of processed tonnes, variability was part of the ramp-up plan. To test the mill’s ability to run at higher throughputs, in June and July the mill was fed a combination of mined and stockpiled tonnes. Since the start of August, the mill has only processed direct mined tonnes. Madsen’s gold output is now a clear representation of what the mine is producing as the operation progresses towards operational stability.

Focus during Q3 was on balancing the competing priorities of ramp-up projects and regular mining operations. For instance, the need to develop a secondary egress from a key mining complex impacted ore production in August while work on underground power distribution impacted mining optionality in September. The Company also managed labour force availability impacts stemming from the June mine site incident.

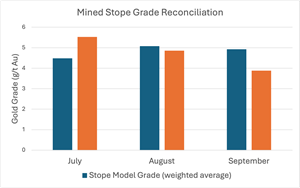

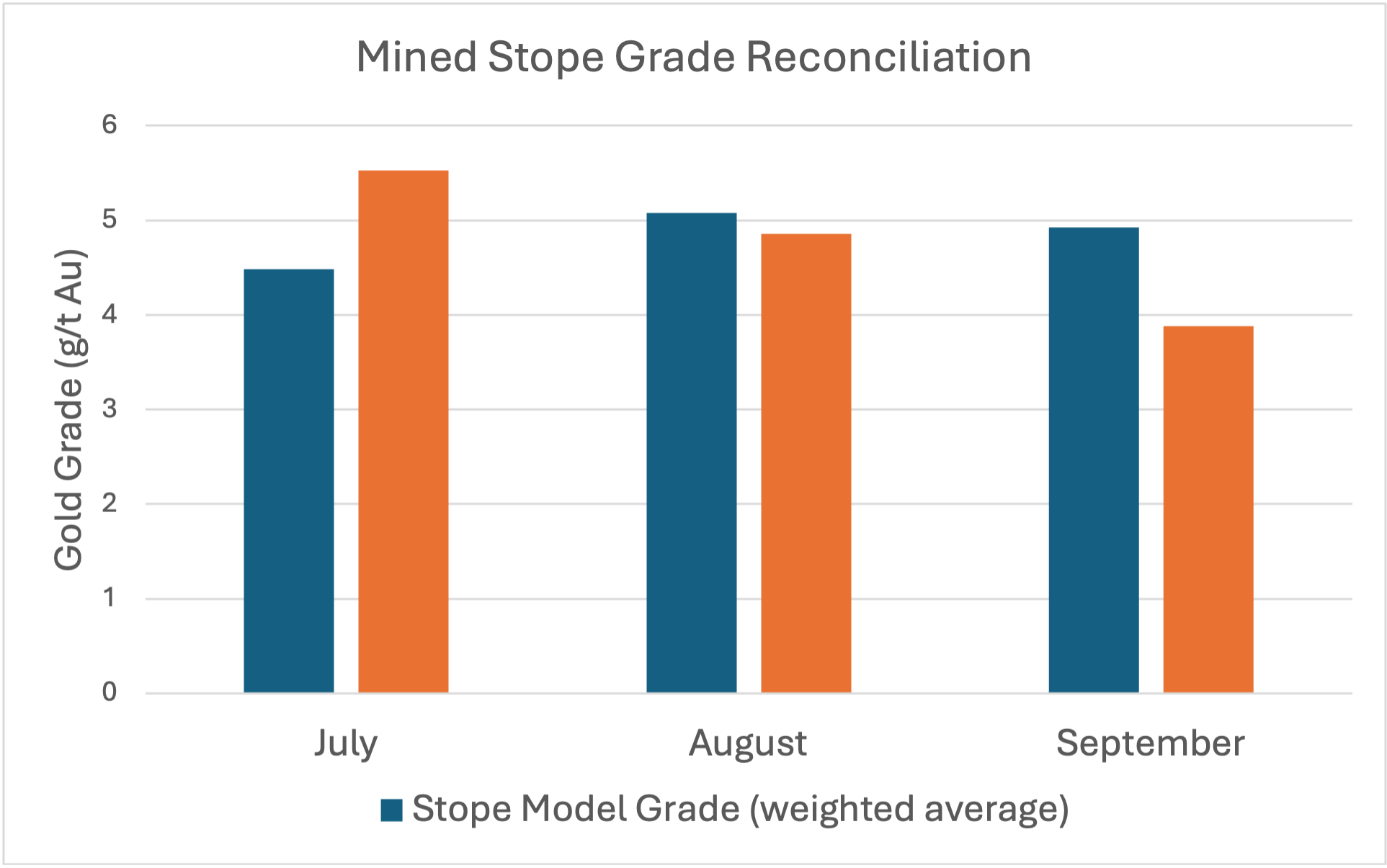

Reconciliation between modeled and actual mined grades remains strong. Figure 2 below shows a comparison of modeled versus actual longhole stope grades. Note that sill development contributed 25 to 30% of milled tonnage over the quarter; Figure 2 does not consider sill tonnes and grade. See Figure 3 for sill grade data.

Figure 2: Comparison of modeled versus actual gold grade in mined longhole stopes. Note this chart does not include sill tonnes and grade.

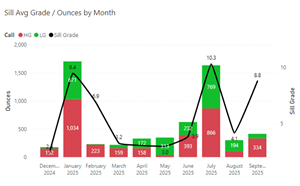

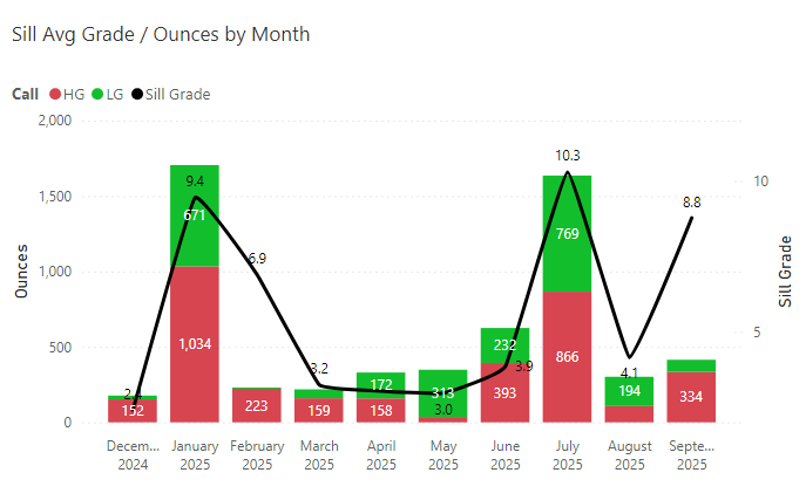

Sill development tonnes continue to outperform on grade. In Q3, mined sill tonnes averaged 8.8 g/t gold.

Figure 3. Sill development gold grade and ounce production at the Madsen Mine.

Equipment availability has improved over the quarter as maintenance systems ramped up. The maintenance team is keeping availabilities for haul trucks, scoops, jumbo drills, and other equipment at target levels.

Pathway to Commercial Production

During the quarter West Red Lake Gold defined the operational components the Company aims to implement before declaring commercial production. With the mine seeing good progress on staffing, the geology-engineering workflow producing good reconciliation and grounding an achievable detailed mine plan, the mill returning strong and consistent recoveries, and other components from maintenance to water treatment also ramping up as expected, focus with respect to commercial production went to operational components, including:

-

Storage of waste rock in historic underground voids. The Madsen Mine produced approximately 2 million ounces of gold from 1936 to 1972. Many mined-out stopes were backfilled, but several large historic stopes were left void. As West Red Lake Gold advances deeper into the mine, such stopes are verified and measured. It was determined that the 1136 void, which is proximal to the 1155 mining complex that is providing 40% of mine’s produced ounces in H2 2025, is significantly larger than expected (65,000 tonnes versus an initial expectation of 34,000 tonnes). It is also a competent void. As a result, this area is now being utilised to store waste rock utilising a combination of cemented rock fill (“CRF”) and dumped waste rock, at rates up to 2,000 tonnes per day.

Since getting this waste storage process operational in mid-September, ore production from the mine has increased because of increased truck availability and ventilation capacity.

-

Skipping 350 tonnes per day up the shaft. The Madsen Shaft was developed in the 1950s; the Company rehabilitated the square timbered shaft in H2 2024. In 2025 management decided to use the shaft to move material. West Red Lake Gold ordered the needed hoist components; the rope was delivered in August while the skip and scrolls are expected in October.

Once these components are installed, the Company expects to start moving 350 tonnes of ore out of the mine each day through the shaft. This is expected to provide notable benefit over trucking these tonnes in terms of cost savings and ventilation capacity.

-

Final equipment deliveries. The mine expects to take delivery of another 42-tonne haul truck and two 4-yard Komatsu scoops over the next two months, which will complete the planned fleet of mining equipment.

The first of these requirements – underground waste storage – is now operational. The shaft is expected to start operating in November and the equipment should be delivered and operational at approximately the same time.

These achievements will create operational stability at the Madsen mine. The 2026 detailed mine plan is also expected before the end of the year, which will enable confident guidance as part of a declaration of commercial production.

“The Madsen Mine remains on track towards commercial production,” states Williams. “We are staying focused on a methodical approach to this ramp up because developing a strong sustainable mine gives us the potential to create more value in Red Lake. Such potential is very apparent in our Rowan project, which we are advancing quickly so that its anticipated production rate of 35,000 ounces adds to our Red Lake production profile within a few years, and we see significant additional value potential at Madsen as we test high-grade targets in and around the deposit and unlock the deeper opportunity of this gold system.”

Additional Information on Recent Financing

In connection with the Company’s bought deal public offering previously disclosed on September 23, 2025, the Company raised an aggregate of C$40,651,260 and the Company paid Raymond James Ltd., as lead underwriter, a cash commission of $2,270,469.60.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Hayley Halsall-Whitney, P.Eng., Vice President of Operations for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a gold mining company that is publicly traded and focused on its flagship high-grade Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world's richest gold deposits. WRLG also owns the Rowan Property in Red Lake, which hosts a small, high-grade deposit that West Red Lake Gold is looking to advance towards production.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release.

Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended December 31, 2024, and the Company’s annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2aed03b6-3340-483e-bdef-a81d1f527daf

https://www.globenewswire.com/NewsRoom/AttachmentNg/cdc1484a-7d2c-425c-b520-f13940612bd2

https://www.globenewswire.com/NewsRoom/AttachmentNg/dbd7237c-df92-4d57-a868-3abd43288d07

https://www.globenewswire.com/NewsRoom/AttachmentNg/6cdee6bd-5d92-4242-906c-927236f468ce

Figure 1. Ore tonnes mined at Madsen on a monthly basis from December 2024 through September 2025.

Figure 1. Ore tonnes mined at Madsen on a monthly basis from December 2024 through September 2025.

Figure 2: Comparison of modeled versus actual gold grade in mined longhole stopes. Note this chart does not include sill tonnes and grade.

Figure 2: Comparison of modeled versus actual gold grade in mined longhole stopes. Note this chart does not include sill tonnes and grade.

Figure 3. Sill development gold grade and ounce production at the Madsen Mine.

Figure 3. Sill development gold grade and ounce production at the Madsen Mine.

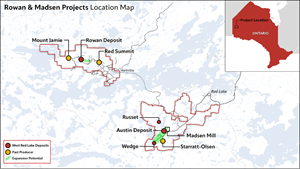

Madsen and Rowan Projects Location Map

Madsen and Rowan Projects Location Map

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.