Loan Management Software Market Competition Analysis 2025: How Players Are Shaping Growth

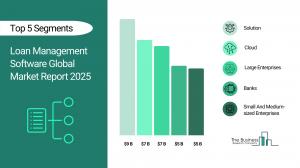

The Business Research Company’s Loan Management Software Global Market Report 2025 - Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 23, 2025 /EINPresswire.com/ -- The Loan Management Software market is dominated by a mix of global enterprise vendors and agile regional fintechs. Companies are focusing on end-to-end automation of the loan lifecycle, cloud-native and application programming interface (API)-first platforms, smarter credit/risk scoring using artificial intelligence (AI)/machine learning (ML), and stronger compliance & data-security capabilities to win bank and non-banking financial company (NBFC) customers. Understanding product differentiation, partner ecosystems (core banking, credit bureaus, payment rails) and regulatory dynamics is critical for stakeholders seeking scale, operational efficiency, and strategic partnerships.

Which Market Player Is Leading the Loan Management Software Market?

According to our research, CoreLogic Inc led global sales in 2023 with a 7% market share. The company partially involved in the loan management software market provides automated default and loss mitigation solutions to accelerate workflows at scale. Additionally, their IntelliVal Automated Valuation Model delivers accurate property valuation estimates using advanced technology. These offerings collectively empower lenders to improve operations, reduce costs and enhance borrower experiences.

How Concentrated Is the Loan Management Software Market?

The market is fragmented, with the top 10 players accounting for 18% of total market revenue in 2023. This level of fragmentation indicates a competitive environment shaped by diverse solution providers catering to regional, regulatory, and operational needs. Despite the presence of several players, high technical complexity, integration challenges, and compliance requirements create substantial entry barriers. Leading companies such as CoreLogic, Finastra, and Intercontinental Exchange hold notable positions through robust analytics capabilities, deep financial data expertise, and end-to-end loan servicing platforms, earning the trust of large financial institutions. As digitization accelerates across banking and lending ecosystems, strategic alliances, product innovation, and platform integration are expected to drive gradual consolidation and reinforce the market presence of established leaders.

• Leading companies include:

o CoreLogic Inc (7%)

o Finastra Group Holdings Ltd (5%)

o Intercontinental Exchange, Inc (3%)

o Temenos AG (0.5%)

o Calyx Software Inc (0.5%)

o TurnKey Lender Inc (0.5%)

o LoanPro Software (0.4%)

o Lendio Systems Pvt. Ltd (0.4%)

o Nelito Systems Pvt. Ltd (0.3%)

o Mambu GmbH (0.2%)

Request a free sample of the LIDAR Market report

https://www.thebusinessresearchcompany.com/sample_request?id=18660&type=smp

Which Companies Are Leading Across Different Regions?

•North America: VoPay International Inc, Peach, Fiserv, Inc, Fidelity National Information Services, Inc. (FIS), Ratehub Inc, Finastra, nCino, Ellie Mae (part of ICE Mortgage Technology), and Mortgage Cadence are leading companies in this region.

• Asia Pacific: Biz Core Pty Ltd, Genawise Australia Pty Ltd, Oomé Inc, EasyLodge Pty Ltd, LoanOptions.ai Pty Ltd, Bank Australia Ltd, Aurionpro Solutions Limited, Pepper Advantage Pty Ltd, PayPay Corporation, ORIX Credit Corporation Ltd, Toss Bank Co, Ltd, Hana Bank Co, Ltd (part of Hana Financial Group Inc.), Lufax Holding Ltd, Yusys Technologies Co, Ltd, Qifu Technology Inc, WeBank Co, Ltd, Credit Engine, Inc, SMBC Consumer Finance Co, Ltd, ABLE Platform Inc, LoansNeo Inc, LoanAssistant Inc, HES FinTech Ltd, TmaxSoft Co, Ltd, ESTsoft Corp, and KOSCOM Inc are leading companies in this region.

• Western Europe: Fneek, Kennek Solutions Ltd, Ingenica Solutions Limited, Sopra Banking Software Limited, Mambu GmbH, HES FinTech, Aryza Holdings Limited, Infinity Enterprise Lending Systems, Temenos AG, and Finastra Group Holdings Ltd are leading companies in this region.

• Eastern Europe: Comarch S.A, Asseco Poland S.A, The Sage Group plc, Finanteq S.A, Tremend Software Consulting SRL, Endava plc, Bittnet Systems S.A, and Diasoft Ltd are leading companies in this region.

• South America: ABLE Platform, HES FinTech, Shaw Systems Associates LLC, Nortridge Software, Timvero OS, Suntell, CloudBankin, Loandisk, Lendscape Limited, and CompassWay are leading companies in this region.

What Are the Major Competitive Trends in the Market?

•Syndicated Loan Management For Financial Institutions is transforming efficiency and automation in managing syndicated loans.

• Example: Cync Software Cync Syndicated Lending (August 2024) assigns automates the servicing of syndicated and participation loans, enabling financial institutions to streamline loan monitoring, fund allocations and participant management with precision.

• These innovations optimizes drawdowns, ensures real-time risk assessment and enhances transparency in collateral valuation, significantly reducing manual effort while improving operational efficiency.

Which Strategies Are Companies Adopting to Stay Ahead?

•Investing in artificial intelligence (AI) and machine learning to improve loan underwriting and risk assessment

• Expanding application programming interface (API) integrations to enable seamless connectivity with third-party financial services

• Strengthening data security and compliance to meet evolving regulatory requirements

• Utilizing cloud-based platforms to enable scalable, flexible, and integrated loan management systems that connect with CRM and accounting software.

Access the detailed Loan Management Software Market report here:

https://www.thebusinessresearchcompany.com/report/loan-management-software-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.