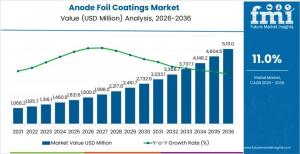

Anode Foil Coatings Market Set to Surge USD 5,111.0 million by 2036, Driven by EV and Energy Storage Demand

Global anode foil coatings market to grow at 11% CAGR, led by innovation in battery technologies fueling EV and grid-scale energy storage growth.

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global anode foil coatings market, a crucial element in the lithium-ion battery manufacturing supply chain, is projected to grow substantially from USD 1,800.0 million in 2026 to USD 5,111.0 million by 2036. This robust growth corresponds to a compound annual growth rate (CAGR) of 11.0%, driven primarily by escalating demand for electric vehicles (EVs), grid-scale energy storage, and high-performance consumer electronics.

Market Overview:

Anode foil coatings serve as the foundation for advanced lithium-ion battery technologies by enhancing the electrochemical and mechanical integrity of battery anodes. These coatings improve adhesion between active materials and current collectors, prevent delamination during charge-discharge cycles, and provide critical corrosion resistance in harsh electrochemical environments. The growing shift toward sustainable transportation and renewable energy adoption globally underpins the increasing importance of anode foil coatings.

Recent advancements in battery technologies, particularly the integration of silicon-based anodes, have raised performance requirements for coating formulations. Silicon anodes expand significantly during operation, necessitating coatings with elastic and self-healing properties to maintain interface integrity. Moreover, coatings now include nanostructured architectures that enhance lithium-ion transport while preventing electrolyte degradation, essential for achieving higher energy densities required by next-generation EVs and storage systems.

Request For Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31538

Market Structure and Key Segments

Copper foil substrates dominate the market with a 72% share due to their superior electrical conductivity and compatibility with lithium-ion battery chemistries. Adhesion and interface control coatings lead in demand, accounting for 36% of the market, emphasizing the need for durable electrode interfaces capable of withstanding thermal and mechanical stresses. Prismatic cells represent the largest format segment at 38%, favored in automotive and stationary energy storage applications for their structural and thermal management needs.

Electric vehicle cells drive market growth, holding a commanding 66% share, reflecting the automotive sector’s accelerated transition to electrification. These applications demand coatings that support fast charging, extended battery life, and stringent safety standards amid dynamic operating conditions.

Geographic Market Insights: Leading Countries and Growth Drivers

The anode foil coatings market exhibits distinct regional dynamics influenced by local manufacturing capabilities, regulatory environments, and industry initiatives:

• China: Leading with a 12.2% CAGR, China’s dominance stems from large-scale battery production by firms like CATL and BYD, supported by government policies favoring EV adoption and renewable integration. Vertical integration and AI-driven manufacturing optimization foster rapid coating innovation.

• Brazil: At an 11.8% CAGR, Brazil benefits from rich lithium reserves and expanding battery manufacturing infrastructure, bolstered by government initiatives targeting sustainable mobility and renewable energy.

• United States: Projected CAGR of 10.8%, fueled by significant government incentives (Inflation Reduction Act, CHIPS Act) and investments from major automakers and battery producers focusing on domestic supply chain security and high-volume production.

• United Kingdom: With a 10.7% CAGR, the UK emphasizes advanced battery research and manufacturing, leveraging institutions like the Faraday Institution and government support to foster innovation in coating technologies aligned with net-zero goals.

• Germany: At 10.6% CAGR, Germany’s automotive and chemical industries drive demand for high-performance coatings, integrating Industry 4.0 and smart manufacturing techniques to ensure product durability and regulatory compliance.

• South Korea: Forecasted at 10.2% CAGR, South Korea’s established battery technology ecosystem underpins sophisticated coating applications that support high-energy-density solutions for global markets.

• Japan: Expected growth at 9.5% CAGR, characterized by precision manufacturing and quality-driven approaches to coating formulations supporting battery longevity and reliability.

Industry Trends and Innovation Drivers

Manufacturers are advancing coating technologies through integrated deposition processes combining plasma treatment, chemical vapor deposition, and solution-based techniques, producing multilayer coatings with multifunctional properties. Precision coating thickness and adhesion controls enabled by real-time quality monitoring are elevating production standards.

Environmental regulations are steering the industry toward sustainable coating chemistries, including water-based and solvent-free formulations, despite technical challenges related to coating uniformity. Compliance with volatile organic compound (VOC) restrictions and recycling requirements drives innovation in eco-friendly materials and closed-loop solvent recovery systems.

The advent of next-generation battery chemistries such as solid-state electrolytes and lithium metal anodes opens new market opportunities. Coatings tailored for these chemistries must facilitate ionic transport across solid interfaces and prevent dendrite formation, demanding highly specialized electrochemical and mechanical properties.

Competitive Landscape

The market is highly competitive, featuring major players such as Furukawa Electric, Nippon Denkai, JX Metals, Iljin Materials, and Doosan. Companies differentiate through advanced R&D capabilities, integrated coating solutions, and strategic partnerships with battery manufacturers to tailor coatings for evolving cell designs.

Innovation cycles are intensifying, with heavy investments in pilot coating lines, advanced characterization equipment, and sustainable technologies. The ability to deliver comprehensive technical support and maintain local presence globally is increasingly critical as battery manufacturing expands geographically.

Outlook

The anode foil coatings market is positioned for sustained growth, driven by the electrification of transportation, expansion of renewable energy storage, and continuous evolution of battery chemistries. Industry stakeholders focusing on technological innovation, environmental compliance, and manufacturing integration will lead the market through 2036.

Browse Related Insights

Paper Pigments Market Share Analysis: https://www.futuremarketinsights.com/reports/paper-pigments-market-share-analysis

White Cement Market Share Analysis: https://www.futuremarketinsights.com/reports/white-cement-market-share-analysis

Cyclohexanone Market Share Analysis: https://www.futuremarketinsights.com/reports/cyclohexanone-market-share-analysis

Bonded Leather Market Share Analysis https://www.futuremarketinsights.com/reports/bonded-leather-market-share-analysis

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.