Market Insights: The Strategic Evolution Of Conductive CNT Dispersions For Battery Electrodes

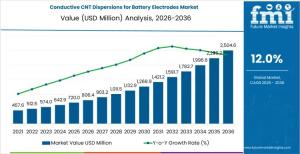

conductive cnt dispersions for battery electrodes market is projected to grow from USD 806.4 million in 2026 to USD 2,504.6 million by 2036, at a CAGR of 12.0%.

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global battery landscape is undergoing a fundamental shift in material science, moving from traditional conductive additives toward high-efficiency Carbon Nanotube (CNT) dispersions. As of 2026, the market for conductive CNT dispersions for battery electrodes is valued at USD 806.4 million, with a projected trajectory to reach USD 2,504.6 million by 2036. This growth, characterized by a 12.00% CAGR, is propelled by the automotive industry's relentless pursuit of high-nickel cathodes, silicon-rich anodes, and ultra-fast charging architectures.

In the "Gigafactory Era," the bottleneck for energy density and rate performance is no longer just the active material, but the efficiency of the conductive network that connects it. CNT dispersions have emerged as the premier solution, offering a three-dimensional conductive highway that enables thicker electrodes and reduced inactive material loading.

Market Dynamics: Beyond Simple Conductivity

The Shift to High-Energy Electrode Engineering

Traditional carbon black additives require high loading levels (often 3–5%) to reach the percolation threshold, occupying valuable volume that could otherwise be used for active materials. In contrast, CNT dispersions achieve superior conductivity at loading levels as low as 0.1% to 1.0%.

This efficiency is critical for:

• High-Nickel Cathodes (NMC 811/9-series): These materials are prone to cracking and loss of electrical contact during cycling. The high aspect ratio of CNTs acts as "mechanical rebar," maintaining contact even as particles expand and contract.

• Silicon Anodes: Silicon’s massive volume expansion (up to 300%) during lithiation destroys standard conductive networks. CNTs provide the flexibility and reach needed to span these structural gaps.

• Thicker Electrodes: To achieve 350+ Wh/kg at the pack level, manufacturers are increasing electrode thickness. CNT dispersions ensure uniform electron transport from the current collector to the surface of these deep coatings.

Request For Sample Report | Customize Report | Purchase Full Report -

https://www.futuremarketinsights.com/reports/sample/rep-gb-31529

The Pre-Dispersion Advantage

The market is shifting decisively toward pre-dispersed liquid systems. Raw CNTs are notoriously difficult to handle due to their tendency to agglomerate into "birds' nests" via Van der Waals forces. Battery manufacturers now favor pre-dispersed solutions that integrate seamlessly into existing slurry mixing lines, reducing defect rates (pinholes, clumps) and improving the reproducibility of high-speed coating processes.

Segmentation Analysis

By CNT Type: Multi-Walled (MWCNT) vs. Single-Walled (SWCNT)

• Multi-Walled CNTs (56% Market Share): MWCNTs remain the industry workhorse. Their dominance is rooted in a balance of high electrical conductivity, structural robustness, and a more mature cost profile. They are the standard for current EV traction battery cathodes.

• Single-Walled CNTs (SWCNT): While currently a smaller segment, SWCNTs represent the high-performance frontier. Their exceptional aspect ratio and conductivity make them indispensable for advanced silicon-rich anodes where even MWCNTs struggle to maintain long-term contact.

By Application: The EV Traction Battery Engine

• EV Traction Batteries (46% Market Share): This segment is the primary engine of the 12.00% CAGR. The sheer volume of material required for a single 80kWh pack compared to a smartphone battery creates a massive demand multiplier.

• Stationary Energy Storage (ESS): As grid-scale storage moves toward LFP (Lithium Iron Phosphate) chemistries optimized for 10,000+ cycles, CNT dispersions are being utilized to enhance the cycle life and thermal stability of these massive installations.

Regional Landscape: The Rise of the Gigafactory Hubs

• China (13.2% CAGR): Maintains global leadership through its dominant position in LFP/NMC cell production and a highly integrated domestic supply chain.

• Brazil (12.8% CAGR): Emerging as a high-growth market driven by the rapid expansion of electric bus fleets and large-scale stationary energy storage projects.

• United States (11.7% CAGR): Growth is significantly accelerated by the Inflation Reduction Act (IRA), which is fueling a massive wave of domestic gigafactory construction.

• Germany (11.6% CAGR): Demand is anchored by premium EV OEMs (such as BMW, Mercedes-Benz, and VW) that require advanced CNT dispersions to achieve ultra-fast charging rates.

• South Korea (11.2% CAGR): Sustained by its established leadership in global Tier-1 cell supply, supporting major manufacturers like LG Energy Solution, SK On, and Samsung SDI.

Competitive Landscape and Key Players

The competitive arena is bifurcated between traditional chemical giants and specialized nanomaterial innovators.

• Integrated Leaders: LG Chem and Jiangsu Cnano Technology lead through vertical integration, controlling both the CNT synthesis and the proprietary dispersion formulations.

• Carbon Specialists: CABOT Corporation and Birla Carbon are leveraging decades of experience in conductive blacks to offer hybrid systems that combine the low cost of carbon black with the high performance of CNTs.

• Nanotech Pioneers: OCSiAl continues to dominate the Single-Walled (SWCNT) niche, pushing the boundaries of what is possible in silicon-anode conductivity.

• Polymer & Coating Experts: Mitsubishi Chemical Group and Arkema are focusing on the "slurry compatibility" aspect, developing binders and dispersants that ensure CNTs remain stable in both NMP and aqueous-based systems.

Key Market Takeaways

• Purity is Paramount: At the 2026 node, battery manufacturers are demanding ultra-low metal impurity levels (typically <50 ppm) in CNT dispersions to prevent internal short circuits and self-discharge.

• Viscosity Control: As coating speeds exceed 80 meters per minute, the rheological behavior of the CNT-laden slurry has become a critical specification.

• Sustainability: There is an increasing push for NMP-free (water-based) dispersions to align with tightening environmental regulations in Europe and North America.

The Road Ahead: 2036 Forecast

By 2036, the market is expected to reach USD 2,504.6 million. The evolution will likely be characterized by:

1. Hybridization: The move toward "conductive cocktails" that blend various CNT types with graphene for optimized 3D/2D conductive networks.

2. Solid-State Integration: As solid-state batteries move toward commercialization, CNT dispersions will be vital for maintaining contact in the solid-electrolyte interface.

3. Cost Deflation: Increased scale and automated synthesis will likely drive down the price of MWCNTs, making them standard even in budget-tier EV segments.

Similar Industry Reports

Battery Pack Foils Market

https://www.futuremarketinsights.com/reports/battery-pack-foils-market

Battery Fire Retardants Market

https://www.futuremarketinsights.com/reports/battery-fire-retardants-market

Battery Thermal Plates Market

https://www.futuremarketinsights.com/reports/battery-thermal-plates-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.